Accounting for Assets and Liabilities

Notes

ASSETS

PROPERTY, PLANT AND EQUIPMENT - lAS 16,

The objective of this Standard is to prescribe the accounting treatment for property, plant and equipment so that users of the financial statements can discern information about an ,entity's investment in its property, plant and equipment and the changes in such investment. The principal issues in accounting for property, plant and equipment are the recognition of the assets, the determination of their carrying amounts and the depreciation charges and impairment losses to be recognised in relation to them.

Property, plant and equipment are tangible items that:

(a) Are held for use in the production or supply of goods or services, for rental to others, or for administrative purposes; and

(b) Are expected to be used during more than one period.

(c) The cost of an item of property, plant and equipment shall be recognised as an asset if, and only if:

i) It is probable that future economic benefits associated with the item will flow to the entity; and

ii) The cost of the item can be measured reliably.

Measurement at recognition: An item of property, plant and equipment that qualifies .for recognition as an asset shall be measured at its cost. The cost of an item '.if property, plant and equipment is the cash price equivalent at the recognition date. If payment is deferred beyond normal credit terms, the difference between the cash price equivalent and the total payment is recognised as interest over the period of credit unless such interest is recognised in the carrying amount of the item in accordance with the allowed alternative treatment in lAS 23.

The cost of an item of property, plant and equipment comprises:

(a) Its purchase price, including import duties and non-refundable purchase taxes. After deducting trade discounts and rebates

(b) Any costs directly attributable to bringing the asset to the location and condition necessary for it to be capable of operating in the manner intended by management.

(c) The initial estimate of the costs of dismantling and removing the item, and restoring the site on which it is located, the obligation for which an entity incurs either when the item is acquired or as a consequence of having used the item during a particular period for purposes other than In produce inventories during that period.

Measurement after recognition: An entity shall choose either the cost model or the revaluation model as its accounting policy and shall apply that policy to an entire class of property, plant and equipment.

Cost model: After recognition as an asset, an item of property, plant and equipment shall be carried at its cost less any accumulated depreciation and any accumulated impairment losses.

Revaluation Model: After recognition as an asset, an item of property, plant and equipment whose fair value can be measured reliably shall be carried at a revalued amount, being its fair value at the date of the revaluation less any subsequent accumulated depreciation and subsequent accumulated impairment losses. Revaluations shall be made with sufficient regularity to ensure that the carrying amount does not differ materially from that which would be determined using fair value at the balance sheet date.

If an asset's carrying amount is increased as a result of a revaluation, the increase shall be credited directly to equity tinder the heading of revaluation surplus. However, the increase shall be recognised in profit or loss to the extent that it reverses a revaluation decrease of the same asset previously recognised in profit or loss. If an asset's carrying amount is decreased as a result of a revaluation, the decrease shall be recognised in profit or loss. However, the decrease shall be debited directly to equity under the heading of revaluation surplus to the extent of any credit balance existing in the revaluation surplus in respect of that asset.

Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. Depreciable amount is the cost of an asset, 'or other amount substituted for cost, less its residual value. Each part of an item of property, plant and equipment with a cost that is significant in relation to the total cost of the item shall be depreciated separately. The depreciation charge for each period shall be recognised in profit or loss unless it is included in the carrying amount of another asset. The depreciation method- used shall reflect the pastern in which the asset's future economic benefits are expected to be consumed by the entity.

The residual value of an asset is the estimated amount that an entity would currently obtain from disposal of the asset, after deducting the estimated costs of disposal, if the asset were already of the age and in the condition expected at the end of its useful life.

To determine whether an item of property, plant and equipment is impaired, an entity applies IAS 36 Impairment of Assets.

The carrying amount of an item of property, plant and equipment shall be derecognized:

(a) on disposal; or

(b) When no future economic benefits are expected from its use or disposal. ,

MEANING OF DEPRECIATION

Depreciation is the diminution in the value of assets due to wear and tear or due to just passage of time. In actual practice, both of these factors operate.

True profits of a business cannot be ascertained unless depreciation has been allowed for.

Depreciation means a fall in the quality or value of an asset. The net result of an asset's depreciation is that sooner or later, the asset will become useless. The factors that cause depreciation are:

1. Wear and tear due to actual use

2. Efflux of time � mere passage of time will cause a fall in the value of an asset even if it is not used,

3. Obsolescence � a new invention or a permanent change in demand may render the asset useless.

4. Accidents

5. Fall in market prices.

The fact to remember is that except in a few cases (e.g. land and 'old paintings) all assets depreciate. Though current assets may also lose value, the term depreciation is used only in resPect of fixed assets and is usually confined to the fall in value caused by factors one and two mentioned above.

THE BASIC FACTORS IN DEPRECIATION

For calculating depreciation, the basic factors are:

i. The cost of the asset

ii. The estimated residual or scrap value at the end of its life

iii. The estimated number of years of its life (not the actual but the number of years it is likely to be used by the firm). Machinery maybe capable of running for thirty years, but, say, due to new inventions, it will be in use only for ten years, then the estimated life is ten years and � not thirty years.

So much depreciation has to be provided as will reduce the value of the asset to its scrap value at the end of its estimated life. The Companies Act requires companies to write off or provide for depreciation in a specified manner.

Objectives of Providing Depreciation

1. To ascertain true value of assets and financial position: The value of assets diminishes over a period of time on account of various factors. In order to present a true state of affairs of the business, the assets should be shown in the Balance Sheet, at their trite and fair values. If the depreciation is not provided, the asset will appear in the Balance Sheet at the original value. So, in order to show the true financial position of a business, it is imperative to charge depreciation on the assets. If depreciation is not provided, the value of assets will be shown at inflated value in the Balance Sheet. By this means, fixed assets will not represent true and correct state of affairs of business.

2. To make provision for replacement of worn out assets: All the fixed assets used in the business require replacement after the expiry of their useful life. The need for replacement can be due to many reasons like change in technology, taste, fashion or demand, which makes a particular asset useless causing permanent loss in its value. To provide requisite amount for replacement of this depreciating asset, annual depreciation is charged to Profit & Loss Account. The amount so provided may be retained in business by ploughing back or invested in outside securities to make the funds available for replacement purposes. Practically, the provisions so provided for depreciation help to recoup the expired cost of the assets used, depleted or exhausted.

3. To calculate correct amount of profits or loss: Matching principles states that the expenses or costs incurred to earn revenue must be charged to Profit & Loss Account for the purpose of correct computation of profit. When an asset is purchased, it is nothing more than a payment in advance for the use of asset. Depreciation is the cost of using a fixed asset. To determine true and correct amount of profit or loss, depreciation must be treated as revenue expenses and debited to Profit & Lass Account. Like any other operating expenses, if depreciation is� not provided, the profits will be inflated and losses understated.

4. To compute cost of production: depreciation not only facilitates financial accounting in computation of profits but it is also an important element of cast determination process. In the absence of depreciation, it is very difficult to ascertain the actual cost of production, process, batch, contract and order of a product. Although the method of charging depreciation is entirely different, without depreciation, no costing system is complete.

5. To comply with legal provisions: Section 205 of the Companies Act 1956 provides that depreciation on fixed assets must be charged and necessary provision should be made before the company distributes dividends to its shareholders, Hence, depreciation is charged to comply with the provisions of the Companies Act.

6. To avail of tax benefits; The income statement of Account will show more profits if depreciation is not charged on assets. In this case, the business needs to pay more income tax to the government. Depreciation charges on assets save the amount of tax equivalent to tax rate. Since it is shown as expense in the income statement of Account, it shrinks the amount of profit.

METHODS FOR PROVIDING DEPRECIATION

The following are the various methods for providing depreciation �

(a) Fixed percentage on Original or Fixed Installment or Straight Line Method

(b) Fixed percentage on Diminishing Balance or Reducing Balance Method

(c) Sum of the Digits Method

(d) Annuity Method

(e) Depreciation Fund Method

(f) Insurance Policy Method

(g) Revaluation Method

(h) Depletion Method

(i) Machine Hour Rate Method

(j) Repairs Provision Method

(a) Fixed Percentage on Original Cost

Under this method, a suitable percentage of original, cost is written off the asset every year. Thus, if an asset costs Shs.20, 000 and ten percent depreciation is thought proper, Shs.2, 000 would be written off each year.

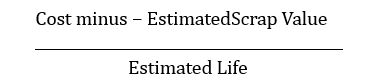

The amount to be written off every year is arrived at as under;

In the case of companies, the scrap value is assumed to be five percent of the original cost of the asset. In other words, ninety five percent of the cost-of an asset is to be written off over its life.

The tile oldie asset is to be reckoned by reference to the rate recognized by the Income-tax Rules. The Rules lay down that depreciation is to be provided by applying the prescribed rate to the reducing book figure or the asset as a result of the depreciation charge.

The period for which the asset is used in a particular year should also be taken into account, Thus, if the asset is purchased on first April, and the books are closed on thirty first December, only nine months' depreciation should be written off in the first year, though income tax authorities will permit depreciation for a full year even if the asset is used only for a short while.

This method is useful when the service rendered by the asset is uniform from year to year. It is desirable, when this method is in use, to estimate the amount to be spent by way of repairs during the whole life of the asset and provide for repairs each year at the average, actual repairs being debited against the provision.

(b). Fixed Percentage on Diminishing Balance

Under this method, the rate or percentage of depreciation is fixed, but it applies to the Value at which the asset stands in the books in the beginning of the year.

In the first year, depreciation is written off proportionate to the actual period in use. The depreciation on Shs.20. 000 - the cost of the asset - at the rate of ten percent will be Shs.2, 000 in the first year.

This will reduce the book value of the asset to Shs.18, 000. Depreciation in the second year will be Shs.1, 800, i.e, ten percent of Shs.18, 000.

In the third year it will be Shs.1, 620. It should be noted that, taking the life of the asset to be the same, the rate of depreciation in the second method will be roughly three times the rate under the first method.

Since the real cost of using an asset is the depreciation to be written off plus the amount spent on repairs of the asset, the second method, viz., Fixed Percentage on Diminishing Balance gives .better results.

In the first year of the life of an asset, repairs are light. They rise as the asset gets older: If one follows the first method of depreciation, the total cost of using the asset, Vis a viz., depreciation (which is constant every year) plus repairs, will rise.

Later years will show heavier expense. This is not proper because the asset gives the same service in the later years, as in the earlier years.

The charge to Profit and Loss Account should be uniform. If one follows the second method, depreciation in the earlier years will be heavy but will be lighter as the asset gets old.

Repairs, on the other hand, are light in the earlier years and heavier later. The total of the two - depreciation and repairs - will be roughly constant. This method also recognizes on more fact.

As soon as an asset is put to use, its value, for sale purposes, falls heavily. Under this method, the depreciation is heaviest in the first year. Thus, it reduces the book figure to its appropriate value. Further, Income tax authorities recognize this method.

Both methods ignore interest. When an asset is used, one loses ultimately not only the money spent on acquiring the asset but also the interest which could have been earned on it. The amount to he charged by way of depreciation, therefore, should take into consideration not only the cost of the asset but also the interest.

(c).Sum of the Digits Method

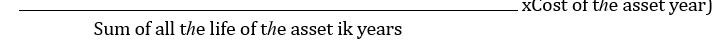

Under this method, the amount of the depreciation to be written off each year is calculated by the formula:

Remaikikg life of tℎe asset (ikcludikg tℎe currekt

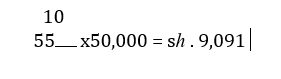

Suppose the He'd an asset costing Shs.50, 000 is ten years. The sum of all the digits one to ten is fifty five. The depreciation to be provided in the first year will be:

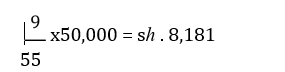

In the second year, it will be:

It will be noticed that the method is similar to the Diminishing Value Method stated above.

(d). Annuity Method

As has been pointed out, the first two methods ignore interest. The annuity method takes into account the interest lost on the acquisition of an asset.

Interest is calculated on the book value of the asset at the current rate and debited to the asset account and credited to Interest Account.

The amount to be written off as depreciation is calculated from the annuity tables. The depreciation will be different according to the rate of interest and according to the period, over which the asset is to be written off.

(e). Revaluation Method

This method is used only in case of small items like cattle (livestock) or loose tools where it may be too much to maintain an account of each single item. The amount of depreciation to be written off is determined by comparing the value at the end of the year (valuation being done by someone having knowledge of the asset) with the value in the beginning.

Suppose on first January, 2005 the value of loose tools was Shs. 1, 600 and during the year Shs.2. 000 worth of tools were purchased.

Now, if at the end of the year, the loose tools are considered to be worth only Shs.2, 400, the depreciation comes to Shs.1, 200, i.e. Shs. 1,600 + 2,000 - 2,400

(f). Depletion Method

This method is used in case of mines, quarries etc. where an estimate of total quantity of output likely to be available should be available.

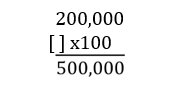

Depreciation is calculated per tonne of output. For example, if amine-is purchased for Shs.2, 00,000 and it is estimated that the total quantity of mineral in the mine is 5, 00,000 tonnes, the depreciation per tonne output comes to 40%.

If the output- in the first year is 30,000 tonnes, the depreciation to be written off in the first year will be 30.000 x 0.40 or Sh. 12,000, in the second year, the output may be.50,000 tonnes; the depreciation to be written off will be Shs.20, 000 i.e. 50,000 x 0.40

(g). Machine hour Rate Method

This is more or less like the .above. Instead of the usual method of estimating the, life of a machine in years, it is estimated in hours. Then an accurate record is kept recording the number of hours each machine is run and depreciation is calculated accordingly

For example, the effective life of a machine may be 30,000 hours. If the cost of the machine is Shs.45,000, the hourly depreciation is Shs.1.50. The depreciation for a particular year during which the machine runs for 2,500 hours will be 2,500 x1.50 or Sh. 3,750

(h).Repairs Provision Method

Institute of Cost and 'Management Accountants of England and Wales defines this method as follows: " The -method of providing for the aggregate of depreciation and maintenance cost by means of periodic charges each of which is a constant proportion of the aggregate of the cost of the asset depreciated and the expected maintenance cost during its life." ,It means that to the cost of the asset (less its estimated scrap value), the amount expected to be spent on its repairs and maintenance throughout its life should be added and the sum then divided by its estimated life.

Suppose an asset costs Shs.60, 000 and has an estimated scrap value of Shs.6, 000; it is expected that its life is fifteen years during which period a sum of Shs.30, 000 is likely to be spent on its repairs and maintenance

The total amount to be written off is Shs.'84,000 i.e. Shs.60, 000 � Shs.6, 000 + Shs.30, 000. Dividend by 15 the amount is Shs.5, 600.

If it is debited to the Profit and Loss Account each year, both depreciation and repairs will be taken care of. Of the amount, Shs.2, 000 should be credited to Repairs Provision Account, i.e. 30,000+15 and the balance Shs.3, 600 credited to Depreciation Provision Account:

Actual repairs will have to be debited to the Repairs Provision Account and not to the Profit and Loss Account. -

ACCOUNTING TREATMENT ON DEPRECIATIONWhen non-current assets are depreciated, a new account for each type of asset is opened; this account is called a provision for depreciation whereby the following entries will be made;

Debit - P&L a/c

Credit � Provision for depreciation a/c

With the amount of depreciation charged for the period.

Illustration

A company starts a business on 1 January 1999, the financial year end being 31 December. You are to show:

a) The plant account.

b) The provision for depreciation account.

c) The balance sheet extracts for each of the years 1999, 2000, 2001, 2002.

The machinery bought was:

|

1999 |

1 January |

1 plant costing shs.8,000

|

|

2000 |

1 July 2 |

2 plant costing shs.5,000

each |

|

|

1 October |

1 plant costing shs.6,000

|

|

2002 |

1 April |

1 plant costing shs.2,000

|

Depreciation is at the rate of 10 per cent per annum, using the straight-line method, plant being depreciated for each proportion of a year.

Plant account

|

Date |

|

Sh. |

Date |

|

Sh, |

|

1999 1/1 |

Cashbook |

8,000 |

31/12 |

Balance c/d |

8,000 |

|

2000 1/1 |

Balance b/d |

8,000 |

|

|

|

|

|

Cashbook |

10,000 |

|

|

|

|

|

Cashbook |

6 ,000 |

31/12 |

Balance c/d |

24,000 |

|

2001 |

|

24,000 |

|

|

24,000 |

|

1/1 |

Balance b/d |

24,000 |

31/12 |

Balance c/d |

24,000 |

|

2002 |

- |

|

|

|

|

|

1/1 |

Balance b/d. |

24,000 |

|

The Smartstudy 2024 Offer!

KES. 300

KES 1500

|