Accounting is considered the language of business. It has evolved throughout the years as

information needs changed and became more complex. After finishing this article, the reader should

be able to have a general understanding about accounting, be acquainted with the different

definitions, know the different types of information found in accounting reports, and know the

different uses of accounting information.

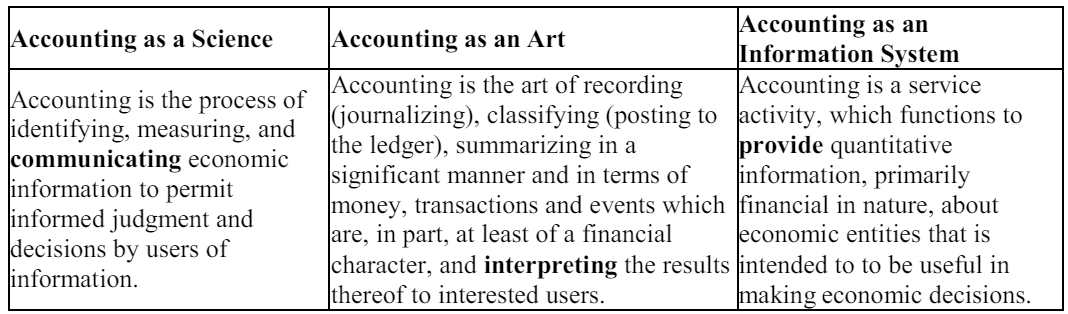

Some say that accounting is a science because it is a body of knowledge which has been

systematically gathered, classified, and organized. It could be influenced by a lot of factors,

specifically by economic, social and political events. Some say that accounting is an art because it

requires creative skill and judgment. Furthermore, accounting is also considered as an information

system because it is used to identify and measure economic activities, process the information into

financial reports, and communicate these reports to the different users of accounting information.

To further understand what accounting is, we must take a look at the different definitions.

The first definition emphasizes the following:

� Identifying - in accounting, this is the process of recognition or non-recognition of business activities as accountable events. Stated differently, this is the process which determines if an event has accounting relevance.

� Measuring - in accounting, this is the process of assigning monetary amounts to the accountable events.

� Communicating - As we could notice with the above definitions, one main similarity between the three is the impact of communication. In order to be useful, accounting information should be communicated to the different decision makers. Communicating accounting information is achieved by the presentation of different financial statements.

The second definition emphasizes the following:

� Recording - The accounting term for recording is journalizing. All the accountable events are recorded in a journal.

� Classifying - The accounting term for recording is posting. All accountable events that are recorded in the journal are then classified or posted to a ledger.

� Summarizing - the items that are journalized and posted are summarized in the five basic financial statements.

The third definition emphasizes that accounting is a service activity and that Information provided by accounting could be classified into 3 types:

� Quantitative information - this is information that is expressed in numbers, quantities or units

� Qualitative information - this is information that is expressed in words

� Financial information - this information is expressed in terms of money

Therefore, given the definitions, accounting is a service activity that is all about recording, classifying and summarizing accountable events in order to communicate quantitative, qualitative, and financial economic information, to different users in order to make relevant decisions.

OBJECTIVES OF ACCOUNTING

The objectives of accounting can be given as follows:

� Systematic recording of transactions - Basic objective of accounting is to systematically record the financial aspects of business transactions i.e. book-keeping. These recorded transactions are later on classified and summarized logically for the preparation of financial statements and for their analysis and interpretation.

� Ascertainment of results of above recorded transactions - Accountant prepares profit and loss account to know the results of business operations for a particular period of time. If revenue exceeds expenses then it is said that business is running profitably but if expenses exceed revenue then it can be said that business is running under loss. The profit and loss account helps the management and different stakeholders in taking rational decisions. For example, if business is not proved to be remunerative or profitable, the cause of such a state of affair can be investigated by the management for taking remedial steps.

� Ascertainment of the financial position of the business - Businessman is not only interested in knowing the results of the business in terms of profits or loss for a particular period but is also anxious to know that what he owes (liability) to the outsiders and what he owns (assets) on a certain date. To know this, accountant prepares a financial position statement popularly known as Balance Sheet. The balance sheet is a statement of assets and liabilities of the business at a particular point of time and helps in ascertaining the financial health of the business.

� Providing information to the users for rational decision-making - Accounting like a language of commerce communes the monetary results of a venture to a variety of stakeholders by means of financial reports. Accounting aims to meet the information needs of the decision-makers and helps them in rational decision-making.

� To know the solvency position: By preparing the balance sheet, management not only reveals what is owned and owed by the enterprise, but also it gives the information regarding concern's ability to meet its liabilities in the short run (liquidity position) and also in the long- run (solvency position) as and when they fall due.

USERS OF ACCOUNTING INFORMATION AND THEIR NEEDS

Users of accounting information could be divided

into 7 major groups which could be easily be remembered using the acronym GESCLIP. This stands for Government, Employees, Suppliers (trade creditors), Customers/Clients/Consumers, Lenders, Investors, and Public. Let us then discuss each user and find out why they need accounting information.

1. Government � the government needs accounting information during its day-to-day operations. The government needs accounting information to assess the amount of tax to be paid by a business or an individual (like the Bureau of Internal Revenue or the Internal Revenue Service when assessing income tax, estate tax, donor�s tax or other taxes); accounting information is needed when determining the fees to be charged in acquiring a business permit or a mayor�s permit; when the Securities and Exchange Commission determines the legality of the amount of share capital subscribed, accounting information is used; when the government deals with certain economic problems like inflation, still accounting information is used. Of course, this list could go on and on.

2. Employees � if you are an employee working in the accounting, finance or sales department, definitely, accounting information is essential. However, the use of accounting information is not delimited to employee working under accounting related departments. Employees need accounting information to know if the business could provide the necessary benefits that is due to them. Through accounting information, employees would not be in the dark with regards to the operations of the firm that they are working for.

3. Suppliers and Other Trade Creditors � suppliers and trade creditors are providers of merchandise on account to different business establishments. Some examples of suppliers are Coca-Cola and Pepsi. Coca-Cola and Pepsi products that are sold to different fast-food chains and supermarkets but are not paid in cash immediately. Before extending credit to customers, Coca-Cola and Pepsi should look into the accounting records of an entity to determine if they would sell their products on account or not. Telecommunication providers like Smart Telecom, Globe, and At&t, could also be considered as suppliers. Before getting a plan from these telecommunication providers, they ask for different proofs of income from the clients availing of a plan. This is because suppliers could determine from the accounting information if a business or an individual has the ability to pay accounts on time.

4. Customers/Clients/Consumers - Customers need accounting information in order to determine the continuity of a business, most especially when there is a long-term engagement between the parties or if the customer is dependent on the enterprise. For instance, students

have to go to a financially stable school that could continue to provide quality education until they graduate. Through accounting information, customers could also check if prices that are being charged are reasonable. Students could look into the financial statements of a school and determine if they are being charged the right tuition fees.

5. Lenders - Lenders have similar needs as suppliers wherein they interested in accounting information that enable them to determine the ability of a client to pay their obligations and the interest attached when the loan becomes due. However, in contrast to suppliers, lenders are providers of money (like banks or lending institutions) while suppliers are providers of tangible goods.

6. Investors and Businessmen - Investors need accounting information in order to make relevant decisions. Through accounting information, they could determine whether to purchase stocks, sell stocks or hold the stock. Businessmen could determine which operations to continue or discontinue, which product line is profitable, and many more. They need to know about the financial performance, position, and cash flows of a business.

7. Public - All of us need accounting information. We want to know the status of the economy, we want to know what is happening with our favorite fast food chains, we want to know the status of retirement plants, families need to budget their money, monitor receipts and disbursements, and many more.

ACCOUNTING EQUATION

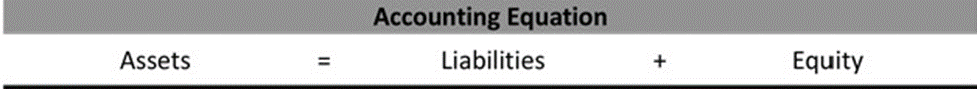

The accounting equation, also called the basic accounting equation, forms the foundation for all accounting systems. In fact, the entire double entry accounting concept is based on the basic accounting equation. This simple equation illustrates two facts about a company: what it owns and what it owes.

The accounting equation equates a company's assets to its liabilities and equity. This shows all company assets are acquired by either debt or equity financing. For example, when a company is started, its assets are first purchased with either cash the company received from loans or cash the company received from investors. Thus, all of the company's assets stem from either creditors or investors i.e. liabilities and equity.

Here is the basic accounting equation.

As you can see, assets equal the sum of liabilities and owner's equity(Capital). This makes sense when you think about it because liabilities and equity are essentially just sources of funding for companies to purchase assets.

The equation is generally written with liabilities appearing before owner's equity because creditors usually have to be repaid before investors in a bankruptcy. In this sense, the liabilities are considered more current than the equity. This is consistent with financial reporting where current assets and liabilities are always reported before long-term assets and liabilities.

This equation holds true for all business activities and transactions. Assets will always equal liabilities and owner's equity. If assets increase, either liabilities or owner's equity must increase to balance out the equation. The opposite is true if liabilities or equity increase.

Now that we have a basic understanding of the equation, let's take a look at each accounting equation component starting with the assets.

Assets

An asset is a resource that is owned or controlled by the company to be used for future benefits. Some assets are tangible like cash while others are theoretical or intangible like goodwill or copyrights.

Another common asset is a receivable. This is a promise to be paid from another party. Receivables arise when a company provides a service or sells a product to someone on credit.

All of these assets are resources that a company can use for future benefits. Here are some common examples of assets:

� Cash

� Accounts Receivable

� Prepaid Expenses

� Vehicles

� Buildings

� Goodwill

� Copyrights

� Patents

Liabilities

A liability, in its simplest terms, is an amount of money owed to another person or organization. Said a different way, liabilities are creditors' claims on company assets because this is the amount of assets creditors would own if the company liquidated.

A common form of liability is a payable. Payables are the opposite of receivables. When a company purchases goods or services from other companies on credit, a payable is recorded to show that the company promises to pay the other companies for their assets.

Here are some examples of some of the most common liabilities:

� Accounts payable

� Bank loans

� Lines of Credit

� Personal Loans

� Officer Loans

� Unearned income

Equity (Capital)

Equity represents the portion of company assets that shareholders or partners own. In other words, the shareholders or partners own the remainder of assets once all of the liabilities are paid off.

Owners can increase their ownership share by contributing money to the company or decrease equity by withdrawing company funds. Likewise, revenues increase equity while expenses decrease equity.

Here are some common equity accounts:

� Owner's Capital

� Owner's Withdrawals

� Revenues

� Expenses

� Common stock

� Paid-In Capital

Example

Let's take a look at the formation of a company to illustrate how the accounting equation works in a business situation.

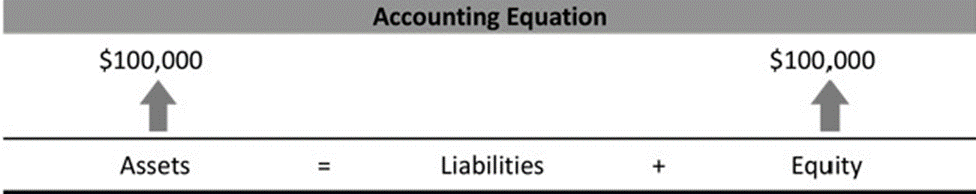

Ted is an entrepreneur who wants to start a company selling speakers for car stereo systems. After saving up money for a year, Ted decides it is time to officially start his business. He forms Speakers, Inc. and contributes $100,000 to the company in exchange for all of its newly issued shares. This business transaction increases company cash and increases equity by the same amount.

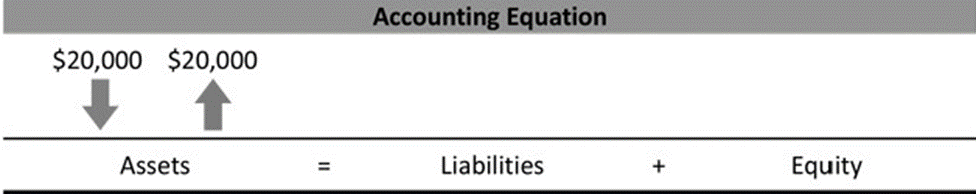

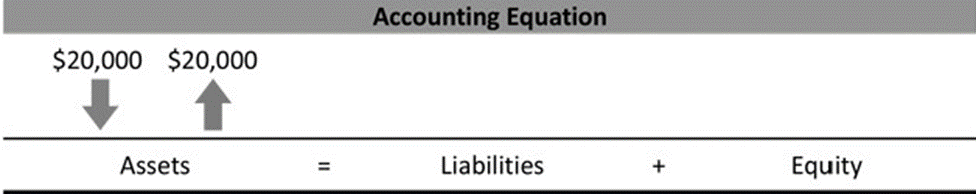

After the company formation, Speakers, Inc. needs to buy some equipment for installing speakers, so it purchases $20,000 of installation equipment from a manufacturer for cash. In this case, Speakers, Inc. uses its cash to buy another asset, so the asset account is decreased from the disbursement of cash and increased by the addition of installation equipment

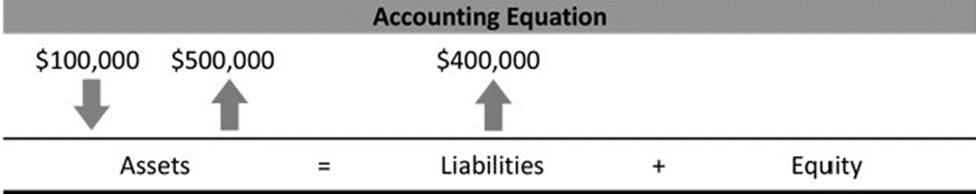

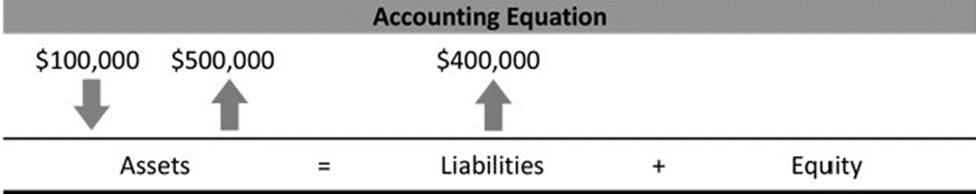

After six months, Speakers, Inc. is growing rapidly and needs to find a new place of business. Ted decides it makes the most financial sense for Speakers, Inc. to buy a building. Since Speakers, Inc. doesn't have $500,000 in cash to pay for a building, it must take out a loan. Speakers, Inc. purchases a $500,000 building by paying $100,000 in cash and taking out a $400,000 mortgage. This business transaction decreases assets by the $100,000 of cash disbursed, increases assets by the new $500,000 building, and increases liabilities by the new $400,000 mortgage.

As you can see, all of these transactions always balance out the accounting equation. This is one of the fundamental rules of accounting. The accounting equation can never be out of balance. Assets will always equal liabilities and owner's equity.

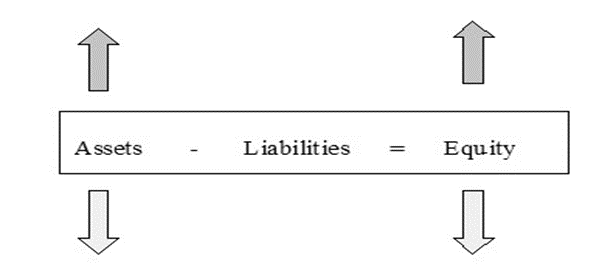

Transactions that affect Assets and Equity of the entity

These transactions result in the increase in Assets and Equity of the entity simultaneously. Conversely, the transactions may cause a decrease in both Assets and Equity of the entity

Any increase in the assets will be matched by an equal increase in equity and vice versa causing the Accounting Equation to balance after the transactions are incorporated.

Example 1

ABC LTD issues share capital for $2,500 in cash

.

Before Transaction: Assets $10,000 - Liabilities $5,000 = Equity $5,000 After Transaction: Assets $12,500* - Liabilities $5,000 = Equity $7,500*

*Assets $12,500 = $10,000 Plus $2,500 (Cash)

*Equity $7,500 = $5,000 Plus $2,500 (Share Capital) 7 500=5 000+2 500

Example 2

ABC LTD pays dividend of $500 in cash.

Before Transaction: Assets $10,000 - Liabilities $5,000 = Equity $5,000

After Transaction: Assets $9,500* - Liabilities $5,000 = Equity $4,500*

*Assets $9,500 = $10,000 Less $500 (Cash)

*Equity $4,500 = $5,000 Less $500 (Divident)

Transactions that affect Liabilities and Equity of the entity

These transactions result in the increase in Liabilities which is offset by an equal decrease in Equity and vice versa.

Any increase in liability will be matched by an equal decrease in equity and vice versa causing the Accounting Equation to balance after the transactions are incorporated.

Example 1

ABC LTD incurs utility expense of $500 which remains unpaid at the period end.

Before Transaction: Assets $10,000 - Liabilities $5,000 = Equity $5,000 After Transaction: Assets $10,000 - Liabilities $5,500* = Equity $4,500*

*Liability $5,500 = $5,000 Plus $500 (Accrued Liability)

*Equity $4,500 = $5,000 Less $500 (Accrued Expense) 4 500=5 000-500

Horizontal format

Name of business

Balance sheet as 31st December

20xx

Sh sh

Sh

Sh sh

Sh

Non-Current

Assets: Capital xxx

Land and buildings xxx Non-current liabilities Plant and machinery xxx Loan xxx

Fixtures, furniture and fittings xxx

Motor vehicle xxx

Current

assets: Current

liabilities

Stocks xxx

Overdraft xxx

Debtors xxx

Creditors xxx xxx

Cash at Bank xxx

Cash in hand xxx xxx

Vertical format

Name of business

Balance sheet as 31st December 20xx

![]()

![]() Sh sh

Sh

Sh sh

Sh